It is really ironic that this question could be formulated by any Hispania’s roman centurion more than 2.000 years ago. Cartago established on the Hispania’s east coast and promote the commerce of mineral deposits and goods in the mediterranean area. Hannibal was devastating Italica and Rome needed to cut their procurement chain between Hispania and Rome. So Rome started the invasion of Hispania about 200 years b.C.

Today, october the 12nd, in the Spanish National Day I saw the new Iberia Airlines Livery shot by an spotter at Toulouse, France (Is it a fake?). IAG spent 10 millions € in this new rebranding strategy of Iberia.

Update: [Oct 15th] The new logo and livery finally revealed today (this article was started on Oct 12th) and it is confirmed that is as shown below.

A few weeks ago, on Sept 26th, 2013, the IAG’s Extraordinary Shareholders meeting approved the acquisition up to 220 new aircraft plus others announced this year:

- 62 + 58 options for the subsidiary Vueling Airlines (A320ceo and neo) that operates 70 aircraft under a leasing contract and they are close to its expiration.

- 100 options of A320neo for British/Vueling and Iberia.

- 18 + 18 options of Boeing 787 and other 18 A350 for British Airways.

- 32 options of A350 and 12 options of B787 for Iberia if it returns to black numbers and gain efficiency.

These numbers reveal that IAG plans to acquire up to 318 new aircraft for the next decade. It seems to be a great bet for the future made by IAG.

But what about Iberia Airlines?

After a couple of years of internal conflicts, an external independent conflict mediation, several strikes, a decreasing of its fleet, now it has about 75 aircraft (+ 14 at Iberia Express). At the end of 2007 Iberia had 137 aircraft, almost 50% more planes (or 35% higher including Iberia Express). So, are there facts that shows the actual Iberia’s situation? The next timeline is taken by the official reports and press notes issued by Iberia, British Airways and IAG during the last 7 years. (2006-2013), this timeline has the intention of describing part of these years’ facts and main milestones.

February 5th, 2006. The new Madrid-Barajas T4 started the operations. Iberia is the major operator in this Terminal with its OneWorld’s partners. This great airport’s expansion had a final cost of 6.200 millions of euros, the objective was to increase the operations from 78 per hour to 120, and handle more than 70 millions of passengers from the previous 35 millions. Iberia said then:

“Iberia has set a goal to convert the ‘new Barajas’ in the “gateway to Europe” for Latin America and, later, for Africa.”

Among the airports of London-Heathrow, Paris-Charles de Gaulle, Frankfurt and Amsterdam-Schiphol, Madrid-Barajas should become the 4th european airport.

July 29th, 2008. Iberia announces the beginning of conversation for a merger with British Airways. As the communication sent to CNMV (Spanish Markets Regulator) said:

“It is expected that such merger will create one of the largest international airlines groups and allow both companies to achieve significant synergies and trade benefits improving the customer service. The union start from the already close relationship between both airlines and serve to reinforce the Oneworld Alliance and Madrid’s position as the leading link between Latin America and Europe”

February 13rd, 2009. The Iberia’s low cost participated Clickair is merged with Vueling (already participated by Iberia). Clickair was founded in october 2006.

November 12nd, 2009. Iberia issued a note about the Memorandum of Understanding of an Iberia-British Airways merger, basis on a 45%-55% participation respectively.

Antonio Vázquez, Iberia CEO’s said:

“This has been a long process, in which many people, both British Airways and Iberia, have worked very hard to reach this agreement. But in the end it was worth it. This agreement is a giant step in the history of Iberia and British Airways, we are laying the groundwork for what will be one of the largest airlines in the world, a truly global airline. I believe that thanks to this operation, which is the largest European airline industry in recent years, we are really well prepared to cope with future challenges.”

British AirwaysCEO, Willie Walsh stated:

“The merger will create a strong European airline capable of competing in the XXI century. Both airlines will retain its brand and culture, while their union will bring significant synergies”

Merger benefits:

For customers:

- Customers will have access to a larger network of destinations to transport passengers and cargo. The newly created group will have more capacity to invest and improvement in new products and services.

- The new Group will offer customers connections to 205 destinations and strengthen the Oneworld alliance, which both airlines belong. British Airways customers will be provided with 54 new destinations, of which 13 are in Latin America, while Iberia’s customers will have 98 new destinations to the network of British Airways. Similarly customers will have more frequency and better connections, more competitive prices, access to more airport VIP lounges and greater advantages in frequent flyer programs.

Strategic improvement position in the global aviation sector:

- Great potential for future growth by optimizing the two hubs of Madrid and London.

- Bigger size and ability to compete with the major airlines and participation in future industry consolidation processes.

Important potential synergies:

- Potential synergies are estimated 400 million euros per year at the end of fifth year after the merger is completed, with a total cost of 350 million euros.These synergies are in addition to those already obtained both companies in the joint operation of routes between Spain and the United Kingdom. Approximately third of the synergies will come from revenue (sales joint network management and incomes), while cost synergies will be achieved in areas such as technology information, aircraft, maintenance and administration functions.

- The Group will have a strong management team for maximizing the revenue potential and reaping the benefits of synergies, keeping operations centers and accounting in each of the operating companies.

July 21st, 2010. Iberia, British Airways and American Airlines have received the approval from the U.S. authorities for the implementation of the Joint Venture Agreement on North Atlantic flights, announced 1 year before. The airlines plan to launch their joint business agreement on North Atlantic routes this fall, allowing them to operate flights linking the European Union, Switzerland and Norway with the United States, Canada and Mexico.

“It is an agreement to share revenue and reduce costs, co-ordinate networks and schedules and co-operate commercially on routes between the EU, Norway and Switzerland and the USA, Canada, Mexico and USA territories” said the official memos.

January 21st, 2011. The merger between British Airways and Iberia was finally completed. The IAG shares began trading in London and Madrid on 24 January at 3,250 € per share.

March 7th, 2011. IAG reaches an agreement with Airbus to purchase eight A330-300 aircraft, and take out options for up to eight A330 family aircraft, for Iberia’s longhaul fleet. The inefficient A340-300/600 need to be replaced. These new planes started to operate at the beginning of 2013.

October 6th, 2011. IAG announced the launch of Iberia Express. “The containment of costs will allow Iberia Express to grow and compete with the low-cost operators” said Iberia Express’ CEO. The labour dispute and conflict started then with SPEAL, the pilot union, that stated then that 8.000 jobs will be cut and 40 aircraft from Iberia will be transferred to the new low-cost airline.

IAG stated then that this new airline will strength the Madrid-Barajas Airport Hub, and create more jobs. Those days Spain were in the middle of the depression storm and very close for a national default. Two months later the government changed from the left party to the right party.

SEPLA announced the first strikes for the end of 2011. This milestone started the labour conflict and the restructuring of Iberia ended this year with the last labour mediation.

November 4th, 2011. IAG agreed in principle to acquire British Midland International (BMI) from Lufthansa, this deal would increase IAG’s share of slots at Heathrow airport from 45% to 54%. So IAG will potentiate the London Hub.

March 25th, 2012. Iberia Express started the operations.

July, 2012. Aena announced a raising fees of 10%. This 10% is the result of a 18% of fees increment for airports and about 7,5% descent in Navigation fees. The calculated impact was 2,10€ per passenger. The airlines revealed against this huge rise. Aena was immersed in a process of decreasing the debt and increasing the aeronautical and non-aeronautical revenues with an IPO at the horizon.

November 8th, 2012. IAG made a cash tender offer to buy 100 per cent of Vueling. The deal finally ended on 26th of april 2013.

November, 2012 to June, 2013 . The restructuring of Iberia bagan, starting from a 22% job cuts (4.500 workers), salary cuts, strikes, another labour mediation that did not satisfy anyone. Finally the judgement issued by the labour mediator stated that 3.141 workers will be fired, 14% salary reduction for pilots and cabin crew, and 7% for the rest of the company. Workers still manifest their disagree and continue with their claims, the following video took place at MAD T4 on february 2013.

August, 2013. Madrid -Barajas looses the symbolic first place of spanish airports traffic, Barcelona leads the operations for a month. the region of Madrid drops the 22% of tourists, the Terminal 4 is quite empty, etc. Iberia reduces 27% its operations, Air Europa rises 19%.

September 26th, 2013. IAG’s Extraordinary Shareholders meeting approved the acquisition up to 220 new aircraft plus others announced this year:

- 62 + 58 options for the subsidiary Vueling Airlines (A320ceo and neo) that operates 70 aircraft under a leasing contract and they are close to its expiration.

- 100 options of A320neo for British/Vueling and Iberia.

- 18 + 18 options of Boeing 787 and other 18 A350 for British Airways.

- 32 options of A350 and 12 options of B787 for Iberia if it returns to black numbers and gain efficiency.

The conflict continues and the doubts increase because the efficiency of Iberia is the key for have new aircraft. In the meantime the modernization of the fleet is planned for the other airlines of IAG.

October 2013. Aena Aeropuertos (Spanish’s airports company) started to plan an expansion program for Madrid-barajas, for new airlines, destinations, offered an agreement to Air Europa for empowering the old Madrid-Barajas Terminals 1, 2 and 3.

Spanish Government started to show, publicly, its worries about Madrid-Barajas airport and Iberia. Please notice that the Spanish Government is preparing an IPO for Aena Aeropuertos for 2014, plans delayed many times since 2011.

Willie Walsh said that 2014 will be a successful year for Iberia.

Iberia presents its new livery and branding. As new CEO (ex Iberia Express) Luis Gallego stated:

“Despite of the social conflicts, Iberia wants to be global and thanks to IAG Iberia has future.” “Iberia changes or dies.”

Numbers

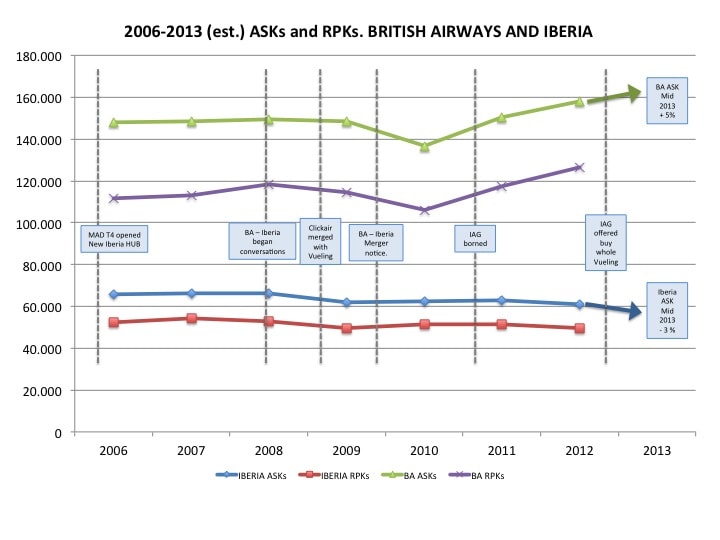

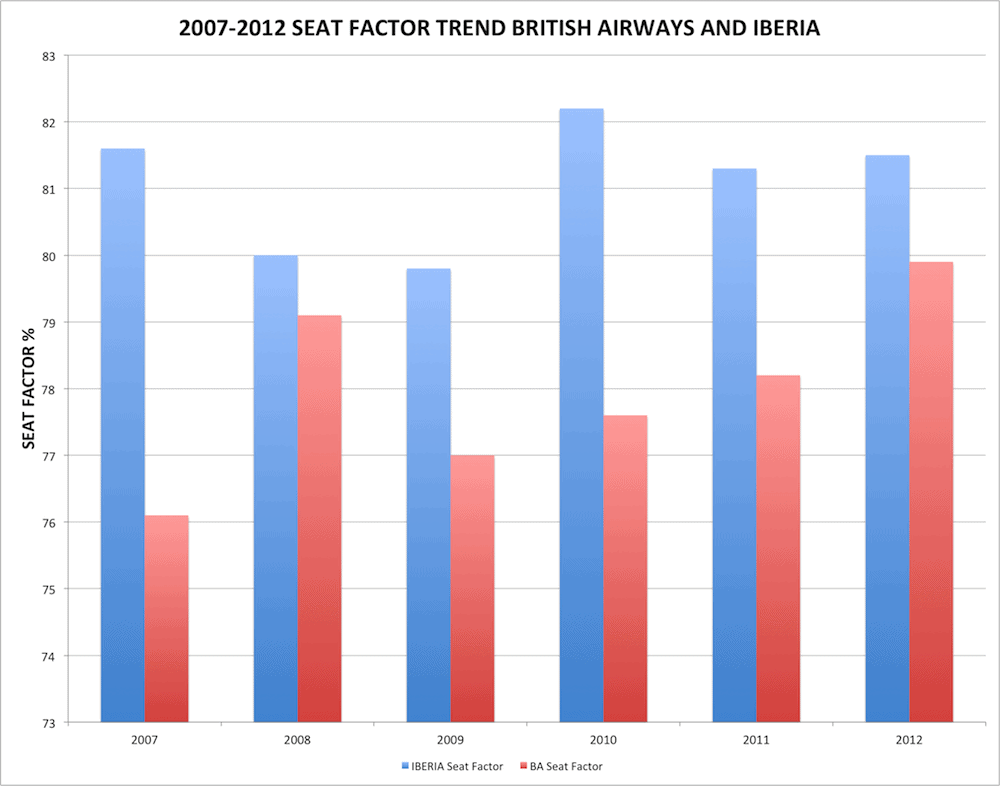

The following graphics and numbers shows the evolution of the ASK, RPK and Seat Factor indicators of Iberia and British Airways.

ASK is the Available seat kilometres (The number of seats available for sale multiplied by the distance flown).

RPK is the Revenue passenger kilometres (The number of passengers that generate revenue carried multiplied by the distance flown).

Seat Factor is the effective occupancy of the flights.

All the data were collected by aeriaa.com from www.cnmv.es (Spanish Markets Regulator) and www.iairgroup.com.

ASK and RPK indicators. A comparative between Iberia and British Airways. Infographic: aeriaa.com Sources: www.cnmv.es and www.iairgroup.com

Seat factor from 2007 to 2012. An iberia and British Airways comparative. Infographic: aeriaa.com Sources: www.cnmv.es and www.iairgroup.com

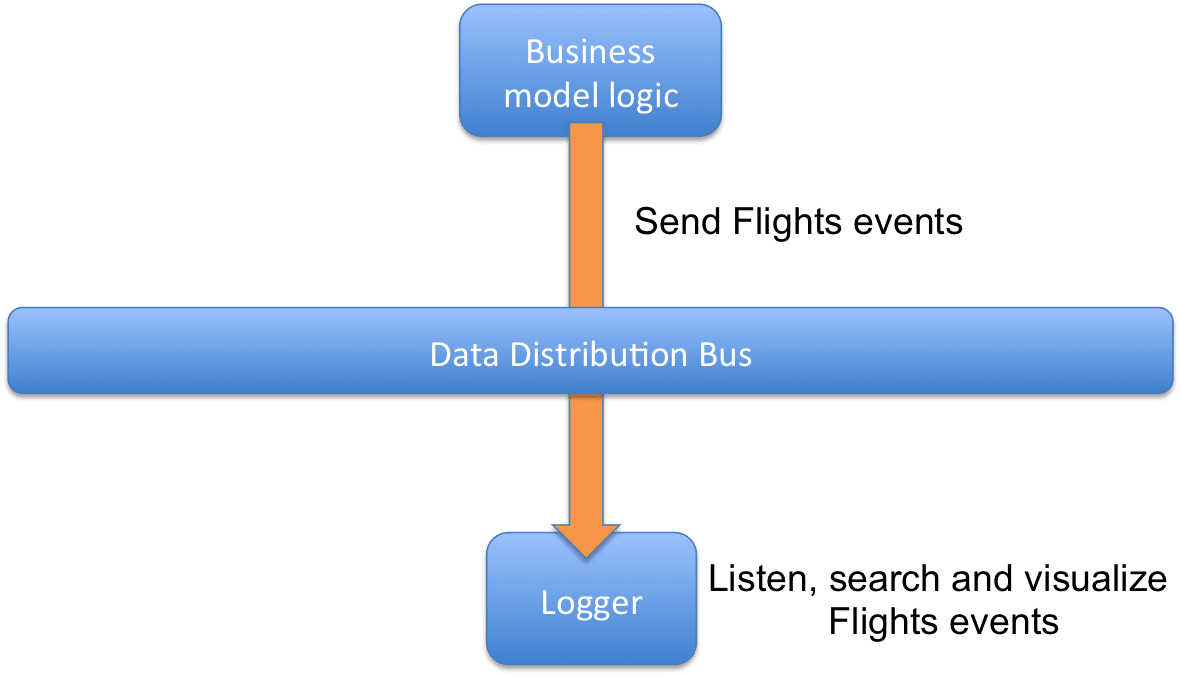

Technology

Once we have reviewed some facts, numbers, etc. What about the IT? It is clear that Iberia is still investing in IT and being innovative during years. This year we saw the new iberia.com (with several original features), the MyBagTag project for home-printing tags, new mobile phone apps, tablets for ramp operations, tablets for cabin crew, virtual assistant at the airport, Agora project…. and many many other public and non public IT projects.

I assisted, two weeks ago, to the Data Science in Aviation Workshop event and Iberia brought a nice presentation titled “Data in the Air”. A kind of Big Brother about the data and performance of their flights, pilots, context at destinations, the behavior of the ATC of some airport, etc. Among others, some topics I really enjoyed were:

- Standard events of each spanish airport. Waiting times, wind, fuel burned at taxiing, etc.

- ATC regulations at destination filtered by the day of the week. i.e: ATC at Heathrow on mondays delayed our flights X minutes, on tuesdays Y minutes…. so we need Z amount of fuel on these days.

- Landing performance of out pilots by fleet and by airport. Bouncing, standard or asymmetric. The A319 fleet performance more bouncing at landing than the A321 and the A340 fleet…. the less bounce fleet are the Bombardier CRJ1000/900.

- Fuel burned by x, y, z attribute.

Conclusions and open questions.

- Iberia came from a long journey of public property and with years of benefits since the company were privatized, the inertia of the business model is enough for the new times?

- Are only the pilot costs, the cabin crew costs, etc. the responsible of the current situation? Did Iberia need its model changed 5 or 10 years ago?

- There is a contrast between IT innovation and the modernization of the fleet, why Iberia is investing in improving its passenger experience, its processes and not in cutting the operation costs with a new fleet? Is it enough with the new A330 fleet?

- What is the real paper of two low-cost carriers as Iberia Express and Vueling competing in the domestic and european market? And related to Iberia short and medium haul routes?

- What is the impact of the Madrid-Barajas 2012 raising fees in the results of Iberia? Why the other companies did not suffer them as Iberia did?

- After two labour mediator judgements, several strikes, salary cuts, spanish crisis, a new low-cost airline, the descent of MAD traffic numbers, routes cancellation, etc, in a very short period of time, does these dramatic context and events the best scenarios and measures for the future of the airline?

- Spain has a enormous tourism industry, will continue Iberia be a key player?

- Not only Iberia is the responsible of its situation, what about the rules context, the fees, the impulse of local authorities for creating the proper conditions for any airline, why a strategical value as the Madrid-Barajas Airport is underused? Where are the strategic plans to make Barcelona-El Prat Airport and Madrid-Barajas complements and empower together the air industry and tourism? There are at least 10 main world high quality spanish destinations, IAG must know it, Does not London-Madrid-Asia-America the best combination possible? Are not the best valued actives of IAG the Heathrow and Madrid Hubs?

Next November 8th, 2013 IAG will present the Q3 2013 Earnings, we will see the next chapters and milestones about the future trends and decisions.

Back to the initial post’s introduction, I wish our contemporaries do not to reply to the question “Quo Vadis Iberia?” – “Londinum vado iterum crucifigi” To London to be crucified.

Long life to Iberia Airlines, long life to its flights, long life to their workers and good judgement from its managerial staff. The huge distance between all these desires must to be closed, it is possible that the golden aviation era disappeared a long time ago, but if in the new aviation model and rules Iberia can compete, please let it try. Some days ago, I read an internal Iberia magazine of 1965 (my grandfather worked at Iberia for more than 20 years), and speaking about marketing and commercial plans, I see that the Passenger Experience have been always pursued, then Iberia had a department called, “Department of claims, suggestions and compliments” That’s all about, deserve the compliments of the customers…. and shareholders. This is the challenge.

Sources:

CNMV: www.cnmv.es

IAG web: www.iairgroup.com

Future travel experience: www.futuretravelexperience.com/2012/08/iberias-project-agora-creating-a-world-class-passenger-experience-in-madrid/

www.saveiberia.com

This work by Pedro Garcia is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 Unported License